Various sectors have increased their use of technology to streamline and better connect with consumers over the last decade. This is particularly true in the banking and financial services industries. Face recognition has been gathering steam over touchscreen. And type-based engagements since the dawn of the digital transformation, owing to the simplicity it provides without jeopardizing transaction security.

There has been an upsurge in financial fraud incidents given the growth in. The use of EMV chips and password generation restrictions. As a consequence of the billions of dollars wasted by large banks. It indicates that banking equipment will rely on facial scans to authenticate. A customer’s identification, which will match comparable scans submitted into the bank’s system by bank employees.

What is Face Recognition System?

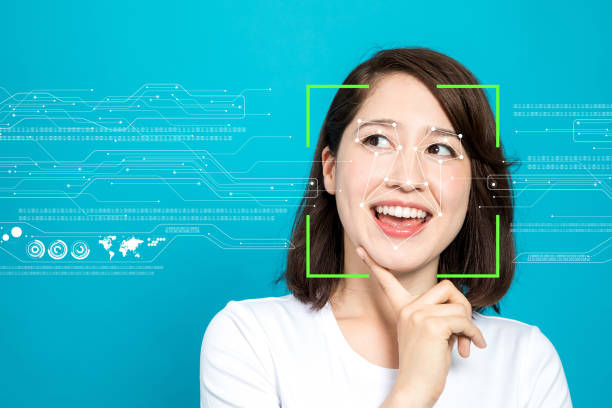

Facial Recognition is a technology that scans, evaluates, and then authenticates. The identity of a face in a video or an image. It is among the most popular and efficient surveillance equipment. People in their daily lives use it to just unlock their phones, however. The way authorities and organizations use it will have a major impact in the modern-day world. If a person is using technology or software, they have the choice to turn off. The facial recognition system, but it is hard to avoid with the frequency of cameras available in public.

How Facial Recognition System Works?

Most people have heard of or seen online face verification software in movies or tv shows. Which is not how it really works. Every face recognition system operates in a different way, but you can sort them out in three basic steps.

Detection

This phase helps find and capture a face in a photograph. Its main goal is to detect the face only, not the identity behind the face.

Analysis

In this step, the software measures the face, usually by calculating the distance between the eyes and between the nose and mouth, the structure of the chin.

Recognition

In this phase, the face-based biometric software tries to authenticate the identity of a person present in the picture. This process is usually used for verification purposes, like on mobile security features, answering a picture-base identification question, or in banks and the financial sector for customer verification. Document Verification service also used for this purpose.

The importance of Facial Recognition for Banks

What are the benefits of combining biometric face recognition technology with banking software? For starters, there are more advantages to this innovation than there are to more traditional ways of the past. The goal is to verify the identification of the account owner and only allow a payment to proceed if the account owner’s identity can be positively verified. This is refer to as KYC (Know Your Customer).

In truth, there is a critical caution to using passwords. People make passwords depending on their knowledge. As a result, a hacker can easily use a variety of techniques to guess the password. Another big problem is that users can have an excessive number of passwords, such as for social media profiles, emails, and e-wallets. Furthermore, creating a difficult password makes it simpler to forget, and when a bank consumer asks for a temporary code through email to recover their password, a bad actor can access the mailbox.

Face recognition implies that a financial client just has to remember one face in order to gain entry to all of the bank accounts. A bad actor can access a user’s social network page and extract critical data, allowing them to complete privacy questions like “what was the name of your kindergarten teacher?” Only a user’s identity is use to identify them using biometric software. A bad actor can only gain entry to a bank account if they know enough about the client. As a result, a banking consumer can engage digitally on a mobile device more easily by first utilizing a device with approved access and then by employing a live face image of themselves captured by the cell phone camera.

This face identifier solution offers a liveness detection feature that prohibits bad actors from impersonating a consumer by utilizing a picture of them. It also extends to other biometric traits, such as fingerprinting, where the liveness detection checks the ‘liveness’ of the face image to ensure that it is a live photo rather than a (still) image or a counterfeit, as is often known. Users can also use laptops to use their bank accounts thanks to the recognition process. It’s feasible thanks to built-in webcams, which are especially common in laptops. Facial biometrics provides an extra degree of protection when signing into their accounts.

Conclusion

The biometric facial recognition solution helps to reduce crime in which internet fraudsters steal from banks by using credentials and other personal information. Before completing any payment, the software confirms a person’s identification.